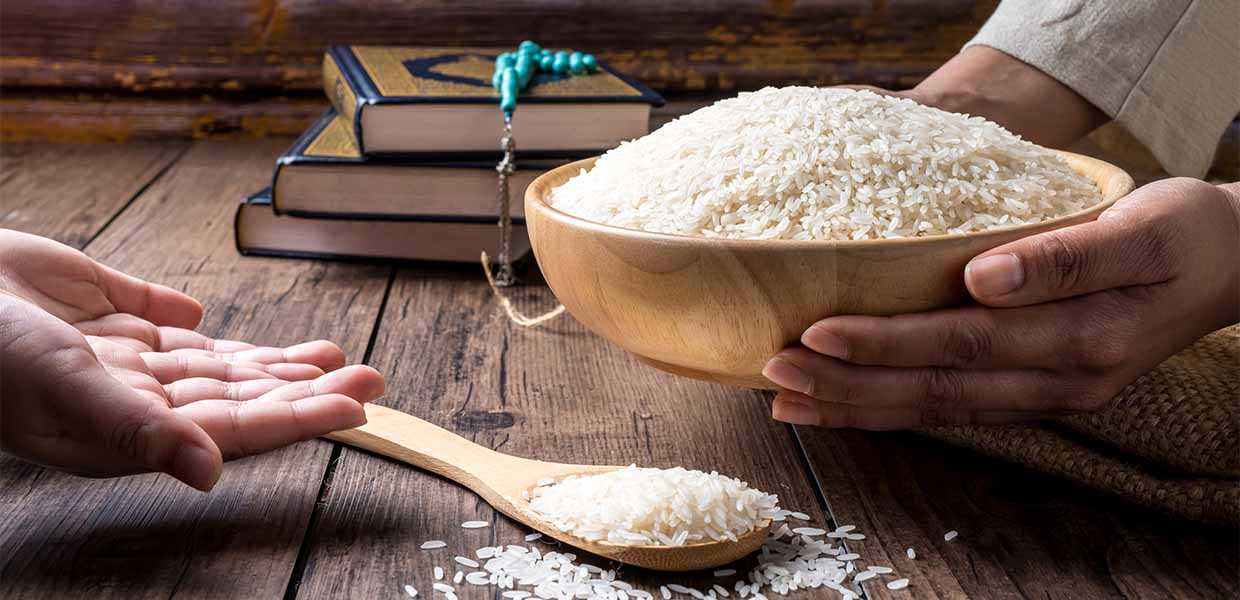

Islam places solidarity and sharing at the very heart of the Muslim identity. One of the most concrete expressions of this understanding is zakat. As one of the Five Pillars of Islam, zakat is not only a personal act of worship but also a powerful means of promoting social justice and equality. Zakat refers to the obligation for Muslims whose wealth exceeds a certain threshold to give a portion of their assets to those in need.

Today, many people ask questions such as “Does my zakat actually reach the right people?” or “Is online donation secure?” In this article, we offer a broad perspective—from the spiritual foundations of zakat to the modern methods of donating it safely and effectively.

Religious Foundations of Zakat

The Qur’an emphasizes zakat in many verses. Its frequent mention alongside prayer highlights its central importance in Islam.

“Those who establish prayer and give zakat and have sure faith in the Hereafter.” (Surah Luqman, 4)

“And in their wealth, there is a rightful share for the needy and the poor.” (Surah Adh-Dhariyat, 19)

The Prophet Muhammad (peace be upon him) also emphasized the importance of zakat in his hadiths, encouraging his followers to perform this act of worship. In one hadith, he said, “Protect your wealth through zakat,” expressing that zakat not only purifies one’s wealth but also brings blessings and protection.

Historical Practice of Zakat

During the time of the Prophet Muhammad, the companions performed zakat with great care. There were official zakat collectors (amil) who ensured that the funds were delivered directly to those in need.

During the caliphate of Umar ibn al-Khattab, zakat was collected through an official state institution and systematically distributed according to the needs of society. This demonstrates that zakat supports not only individual piety but also social order.

Who Can and Cannot Receive Zakat?

Surah At-Tawbah (9:60) clearly identifies eight categories of people eligible to receive zakat: the poor, the needy, zakat collectors, those whose hearts are to be reconciled to Islam, slaves seeking freedom, debtors, those striving in the path of Allah, and stranded travelers.

Those who cannot receive zakat include one’s parents, grandparents, children, and grandchildren. Additionally, zakat cannot be given to the wealthy.

The Difference Between Zakat and Sadaqah

While zakat is a mandatory form of worship, sadaqah (charity) is voluntary. The amount and timing of sadaqah depend on the individual, whereas zakat has fixed rules and specific times. In this way, zakat establishes a stronger and more organized mechanism of social distribution.

How to Calculate Zakat

The standard zakat rate is 2.5% of a person’s qualifying wealth. Gold, silver, cash, trade goods, and agricultural products are subject to zakat. Wealth that exceeds the nisab threshold makes one liable to pay zakat.

Example: A Muslim who owns 150 grams of gold exceeds the nisab threshold and is therefore required to pay zakat. 2.5% of 150 grams equals approximately 3.75 grams of gold, which should be given to those in need.

How to Make a Zakat Donation

A Muslim intending to pay zakat should follow these steps:

- Calculate total assets and check whether they exceed the nisab threshold.

- Determine 2.5% of the total zakatable assets.

By carefully following these steps, one ensures that zakat is fulfilled both spiritually and socially.

Modern Uses of Zakat Funds

Today, zakat funds are not limited to food aid—they support many vital areas such as education, healthcare, housing, and psychosocial assistance.

- Through educational support, children can continue their studies and receive scholarships.

- Healthcare aid enables those in need to access treatment and medication.

- Housing support provides shelter for homeless families.

- Psychosocial projects help children and families recover from trauma.

This diversity shows that zakat serves as a remedy for many of society’s wounds.

Online Zakat Donation and Its Advantages

With technological advancements, making zakat donations has become easier than ever. Through İyilikhane’s online donation system, you can fulfill your zakat obligation in just a few minutes.

The advantages of online zakat donations include:

- Performing your religious duty anytime and anywhere

- Secure payment infrastructure

- Option for regular donations

- Transparency through detailed reports on how donations are used

Today, many Muslims prefer this convenient and secure method to give their zakat. Donate through İyilikhane and help amplify the impact of goodness.

Things to Consider When Giving Zakat

There are certain points to keep in mind when fulfilling the obligation of zakat:

- Avoid showing off—seek only Allah’s pleasure.

- Give from the best of your wealth.

- Whenever possible, give zakat during Ramadan, as rewards multiply greatly in this blessed month.

By following these principles, zakat fulfills both its spiritual and social purposes.

Zakat Donation with İyilikhane

İyilikhane accepts zakat donations transparently and transforms them into education, housing, food, and healthcare support for children and families in need. Donors can easily make zakat contributions through the official İyilikhane website and track how their donations are used through detailed reports. Become a regular donor to İyilikhane and help ensure the sustainability of support.

Zakat is one of the most important acts of worship in Islam. It is not merely a financial responsibility but a system that strengthens social harmony and solidarity. Whether given through traditional means or via İyilikhane’s online platforms, zakat remains a powerful act of faith.

Zakat does not diminish wealth—it blesses it. Every act of giving brings hope to those in need and peace to the giver.

When a Muslim gives zakat, they not only fulfill a spiritual duty but also contribute to the future of their community. By donating through İyilikhane, you can find personal peace while spreading goodness to those in need.